Online lottery ticket company Jackpot announced Wednesday that it closed on $35 million in series A funding, led by some of the biggest names in sports who see the promising growth potential in digital lottery sales.

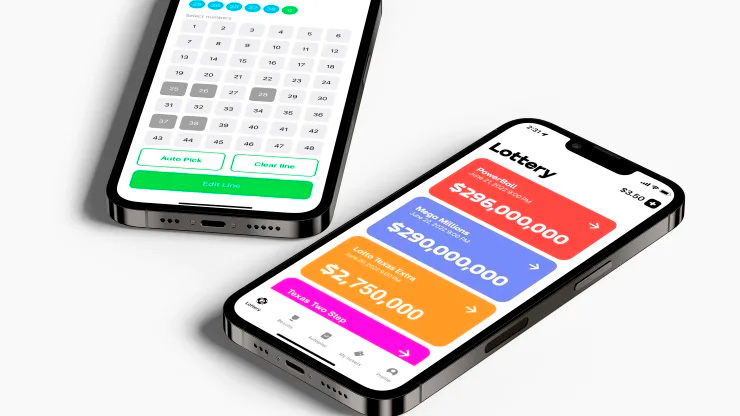

The cash infusion could enable Jackpot to start rolling out its website and app later this year in select locations where online lottery ticket sales are allowed. For example, the company said it could operate in states including New York, New Jersey, Texas, Ohio and Oregon.

Funding for the round was led by Accomplice, a venture capital firm co-founded by DraftKings board member Ryan Moore and Courtside Ventures, an early-stage investor in sports, digital media, fitness and gaming businesses. Also among the investors: the Kraft Group, which owns the New England Patriots; the Haslam Sports Group, which owns the Cleveland Browns; Fanatics CEO Michael Rubin; DraftKings CEO Jason Robins; and Boston Red Sox president Sam Kennedy. NBA superstars James Harden and Joel Embiid and NHL great Martin Brodeur round out some of the big name investors.

“What we are doing is really just allowing you to buy that lottery ticket without ever leaving your couch,” Akshay Khanna, Jackpot co-founder and CEO of North America, told CNBC in an interview.

The $100 billion-a-year lottery business is still mostly cash-based, with buyers getting tickets at bodegas, convenience stores, gas stations and other locations.

Jackpot, which says it wants to transform the business to be more in sync with the online buying habits of today’s consumers, will make its money by charging a convenience fee on purchases. The company added that it’s currently working with local regulators in select states for clearance to roll out the service.

“Over a dozen states have been incredibly receptive to this because they’ve realized that this is actually a fundamentally different channel for the same product,” said Khanna.

In 2021, Jackpot said its research shows 53% of Americans bought lottery tickets but that only about 5% of those were purchased online. Khanna said that making the lottery tickets more widely accessible online will help increase sales revenue for states.

“We certainly think this will appeal to a potentially younger and more diverse demographic,” Khanna said. “It’s one of the reasons why states that are supportive of this model, because one of the goals here is to expand this product to people who maybe traditionally would not have been those that purchase lottery tickets.”

But some critics, like the National Council on Problem Gambling, warn that making access to buy lottery tickets easier could present a slippery slope for at-risk individuals.

“Any form of online gambling inherently gives the user a sense of anonymity and is much easier to hide than other forms of gambling,” said Jaime Costello, the group’s director of programs, in an email. “These characteristics, paired with the instant access to purchasing, results, etc., increase the risk of problems for individuals purchasing lottery tickets online.”

Khanna said Jackpot will have age verification controls and that the company is investing in order to comply with state regulations.

1 thought on “Online lottery ticket company Jackpot gets funding from top sports executives”